In an industry like ours, where costs are not only high but quickly fluctuating, cashflow is important. As a business owner, having good cashflow allows you to have peace of mind and enables you to take care of your clients and employees at a deeper level. Typically, money coming in is dependent on your clients sending the check. We’d like to suggest four simple ways to increase your cashflow. While not all of these will be applicable to every client, implementing one or all is a great start!

Require Deposits

Specifically with Construction or Enhancement work, cashflow can get tight when you have to order material in advance of the job starting. Depending on the size of the job, it may be weeks to months before the job is done. If you require a deposit at signature, you are able to take control of your cashflow.

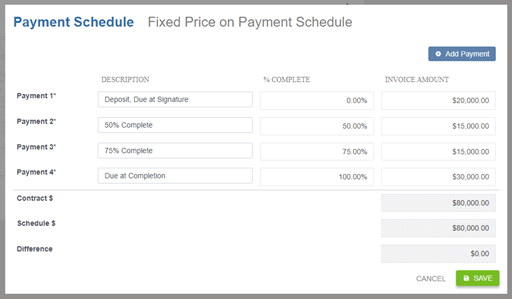

Aspire allows you to determine the invoice type, either Open Billing, Payment Schedule or At Completion. The best way to set up a work order with a deposit is to utilize “Fixed Price on Payment Schedule”. This allows you to not only create a deposit, but you can determine how much you will invoice throughout the duration of the job, based on the percentage of complete. See the example below.

Prepayment Discounts

Deposits are beneficial for work orders, but they don’t account for your Maintenance Contracts. Offering Prepayment discounts are a great tool to increase cashflow. This might look like offering your client a 10% discount if they pay their entire contract amount upfront. This should be offered to the client at time of anniversary/renewal. While clients may be hesitant to pay so much up front, they may find the discount beneficial, especially if they are working with a strict budget.

Electronic Payments

As we mentioned earlier, cashflow is often dependent on your clients sending the money. In most cases, this is because they are paying via check. If you aren’t already set up to receive electronic payments (either ACH or Credit Card), you should consider CardConnect, which integrates seamlessly with Aspire. By getting set up you open the door to a couple of benefits:

While these are both great steps in the right direction, it still leaves you waiting on the client. We suggest adding language into their agreement that electronic payments will be automatically ran on the invoice date.

Collections

At the end of the day, you’ll likely still have a group of clients that won’t prepay, won’t set up electronic payments, and don’t send payment on time. This is why it is still important to have a defined Collections process. We suggest implementing the following steps:

- Send statements monthly (for example, on the 20th of each month).

- Run Aging reports regularly (weekly or biweekly)

- Determine where collection information will be logged

- Utilize Aspire’s “Collection Notes” function for internal notes (log when you emailed/called and what information was gathered).

- If additional team members need to be aware of the late payment, create an Issue category of “Collection Issues”, and create an issue with any necessary information.

If you’re feeling the pressure of tight cashflow and need assistance implementing any of these tips, please reach out to schedule a meeting. We’re here to identify where to start, what the end goal is, and how you will get there most efficiently!

FREE DOWNLOAD:

Future-Proof Your Landscaping Business in 6 Easy Steps

Thrive Leads Shortcode could not be rendered, please check it in Thrive Leads Section!